|

|

February 4, 2014

The market for smart connected devices is changing and it’s doing so at a rate that’s even faster than most people realize. In the process, the whole conception of what computing is, where it happens and even what means is changing and evolving.

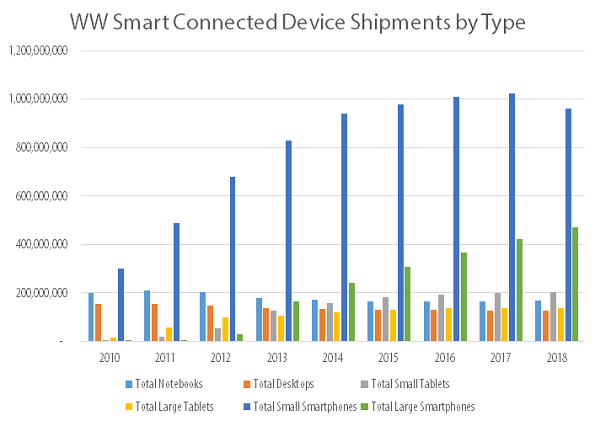

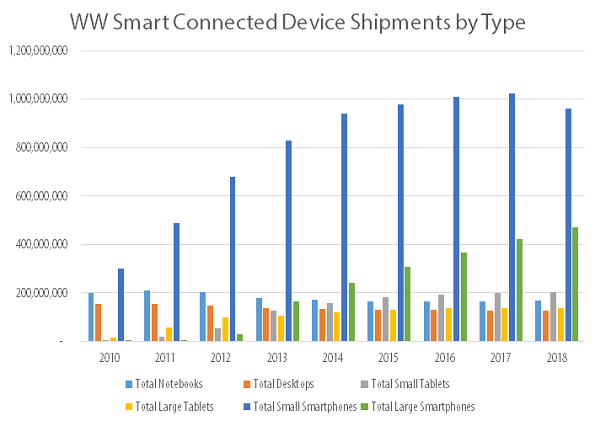

Let me put it another way. This year, my firm TECHnalysis Research predicts that the 2014 shipments of large smartphones (those with screens 5” and larger—commonly called “phablets” but perhaps better coined “mobile connected devices”) will far outsell both small tablets (those with under 8” screens) and even notebook PCs. Specifically, we are forecasting that worldwide phablet unit shipments will reach approximately 240 million in 2014 versus 173 million notebooks and 158 million small tablets. That’s a seismic shift that will have profound implications on branded device vendors, component suppliers, ecosystems, applications and app development, and even regional influence. We’re going to see an increasing influence on mobile operating systems, developing markets and computing devices that fit into your pants pocket or small purse.

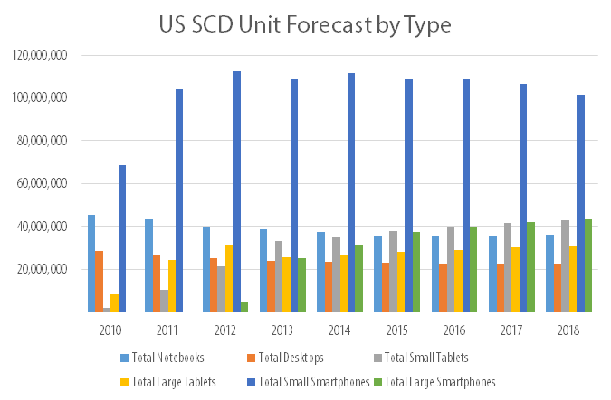

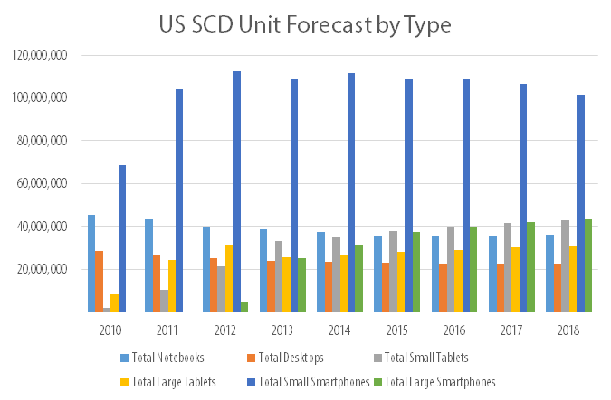

In the US, the story isn’t quite as dramatic, as large smartphones have been a little bit slower to reach mass appeal, but even by 2015 we expect large smartphones to outship notebooks in the US by a margin of 37.5 million to 35.9 million and by 2017 we expect them these mobile connected devices to outsell small tablets in the US (41.9 million versus 41.5 million).

The charts below show our view of the entire smart connected devices market (the combination of PCs, tablets and smartphones—it’s a term I coined while at IDC), split by the six key subcategories: notebook PCs, desktop PCs, small tablets (under 8”), large tablets (8”+), small smartphones (under 5”) and large smartphones (5”+). The top graph shows the WW numbers and the second one shows the US numbers.

In addition to the major transitions in device influence show by these graphs, one of the other key takeaways is that the total smart connected devices market is starting to stabilize and show much more modest growth, especially in the US. The fact is the market for these device categories are all starting to saturate, as people hold onto their devices longer and the need to upgrade is reduced. PCs were the first to suffer this fate, but we believe it will move over to tablets and even smartphones by the end of the 5-year forecast period—again, especially in the US.

As a result, the only way vendors can continue to grow within these categories is to steal share from one another. We believe this is one of the many reasons Apple is likely to enter the large smartphone market later this year. Demand for these devices is particularly strong in the regions where the company wants to grow and even in the US, it will be necessary to help them maintain their share.

The device industry has been on a treadmill of seemingly never-ending growth for decades, but we believe that era of unimpeded growth will be coming to an end by the end of this decade. Of course, many device vendors, ecosystem providers and supply chain partners will transition over to wearable technology and other yet-to-be-discovered product categories in the interim in order to compensate for this change. However, this maturation of core computing devices into a more mature, slower growth industry is bound to bring with it some other unexpected changes that promised to keep this space an exciting and interesting one to watch.

If you’re interested in seeing the highlights of the new TECHnalysis Research forecast document (which covers significantly more than I could cover in a single column), you can download a free copy at https://technalysisresearch.com/sample_research.html.

Here's a link to the original column: http://techpinions.com/computing-redefined-a-smart-connected-devices-forecast/27176

Podcasts

Leveraging more than 10 years of award-winning, professional radio experience, TECHnalysis Research will soon launch regular audio podcasts.

LEARN MORE |

|

Research Schedule

A list of the documents that TECHnalysis Research plans to publish in 2014 can be found here.

READ MORE |

|